Charitable Remainder Trust

Create a stream of income, enjoy tax benefits, and make a future gift to Dartmouth.

Understanding Charitable Remainder Trusts

A charitable remainder trust allows you to use your assets to fund a trust while also creating a stream of income that pays you and your designated beneficiaries an annual distribution.

Depending on the type of charitable remainder trust you select, your annual distribution will be funded in one of two ways: a percentage of the annual value of the trust's principal (unitrust) or a percentage of the initial funding amount of the trust (annuity trust).

How It Works

You can fund a charitable remainder trust with cash, securities, tangible assets, or real estate. Dartmouth sells your asset(s) at market value, invests the proceeds, and manages your irrevocable trust. Income is paid to you or your beneficiaries for life or for up to 20 years.

Dartmouth offers two types: a charitable remainder unitrust pays a variable stream of income; a charitable remainder annuity trust pays a fixed stream of income. The minimum gift amount is $50,000.

Charitable Remainder Unitrust Benefits

A charitable remainder trust (CRUT) is a powerful financial planning tool that enables you to use illiquid assets to fund a trust, meaning property such as real estate or artwork can provide years of income.

Establishing a CRUT can help you maximize your charitable commitment while also creating a stream of income. A CRUT is also an excellent financial planning tool if you're interested in diversifying your assets in a tax-free manner.

Lifetime income (or up to 20 years) for you and/or a beneficiary of your choosing

An immediate charitable tax deduction for a portion of the value of your gift (with a five-year carry forward)

No immediate recognition of capital gains tax on the disposition of the assets in trust

The opportunity to increase your income from low-yield, highly appreciated assets while avoiding capital gain tax on the assets’ long-term appreciation

Reduced estate taxes

A lasting legacy at Dartmouth

The satisfaction of knowing that after the trust has served you for many years, its assets will benefit the College you love

How to Turn Assets into Income While Supporting Dartmouth

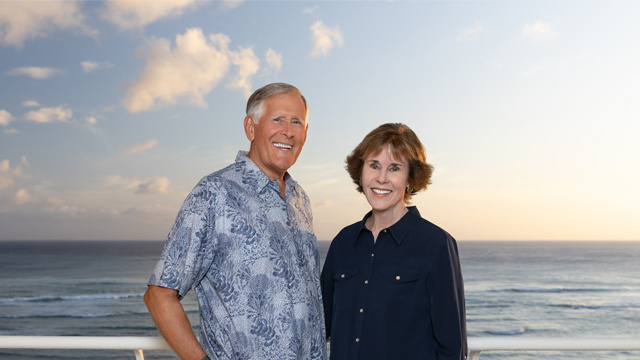

David Mulliken ’65 TU’66 recently established a CRUT to benefit the Tuck School of Business. In recent years, as he and his wife Noreen considered how they might structure their estate, they thought about establishing a family foundation.

However, they chose an approach that will enable them to support organizations that have been meaningful in their lives, such as Dartmouth, while also providing their sons with capital to distribute.

Charitable Remainder Trust Calculator

Use the calculator below to help you evaluate your planned gift options. In the box where you are asked to select the IRS Discount Rate, select the highest rate for a charitable remainder trust.

Please note: Dartmouth’s Gift Planning Office does not provide tax or legal advice. Gift calculations are provided for illustrative purposes only. The actual values may vary based on the timing of your gift. Please consult your attorney or tax advisor prior to entering into any gift planning arrangement.