Charitable Gift Annuities

Make a gift to Dartmouth and receive regular, fixed payments for life

A Gift That Pays You Income

A charitable gift annuity (CGA) is a simple agreement in which you exchange a gift of $10,000+ in cash or other assets for a guaranteed income stream.

When you establish a CGA, you agree to make a gift to the institution and Dartmouth promises to pay you or you and your designated loved one a fixed sum each year for your lifetime(s). After that, the remaining amount supports innovative and life-shaping educational opportunities. Payments can be immediate or deferred, and the assets used to establish a CGA are flexible and can be given in the form of cash, stocks, and even IRA assets (restrictions apply, see below).

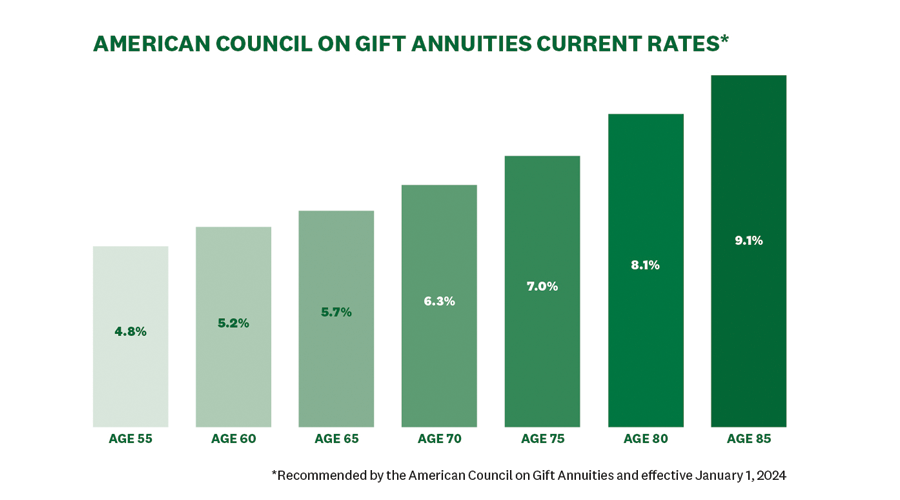

Gift Annuity Rates

Annuity rates are generally determined by the age(s) of the annuitant(s) at the time of the donation, the number of annuitants (maximum of two), and the date on which payments are scheduled to begin. The longer you choose to delay the payments, the higher the payout rate you receive.

Secure Act 2.0

Recent tax law allows for IRA owners age 70-1/2 to exchange a one-time Qualified Charitable Distribution for a life-income gift. While the gift does not qualify for an income tax deduction, there is no income tax liability on the transfer, and it counts toward the donor’s required minimum distribution for individuals age 73+.

An Example of a Charitable Gift Annuity at Dartmouth

An alum is looking to support her financial future and make a lasting impact to the institution she loves. At 65, the alum establishes a charitable gift annuity with a gift of $150,000 from her investment portfolio. Considering the charitable gift annuity rates for age 65, the alum would be entitled to a 5.7% payout — or $8,550 annually for life.

The alum would also receive a charitable income tax deduction estimated at $51,000 in the year the gift is made and, if funded with appreciated property, would be entitled to capital gains tax benefits

Benefits

A charitable gift annuity might be a good option for you if:

- You want the security of a guaranteed fixed income stream for life

- You want to explore income or capital gains tax savings options

- You want to diversify your portfolio

- You want to make a lasting gift to support Dartmouth

Charitable Gift Annuity Calculator

Use the calculator below to help you evaluate your planned gift options. In the box where you are asked to select the IRS Discount Rate, select the highest rate for a gift annuity and a charitable remainder trust.

Please note: Dartmouth’s Gift Planning Office does not provide tax or legal advice. Gift calculations are provided for illustrative purposes only. The actual values may vary based on the timing of your gift. Please consult your attorney or tax advisor prior to entering into any gift planning arrangement.